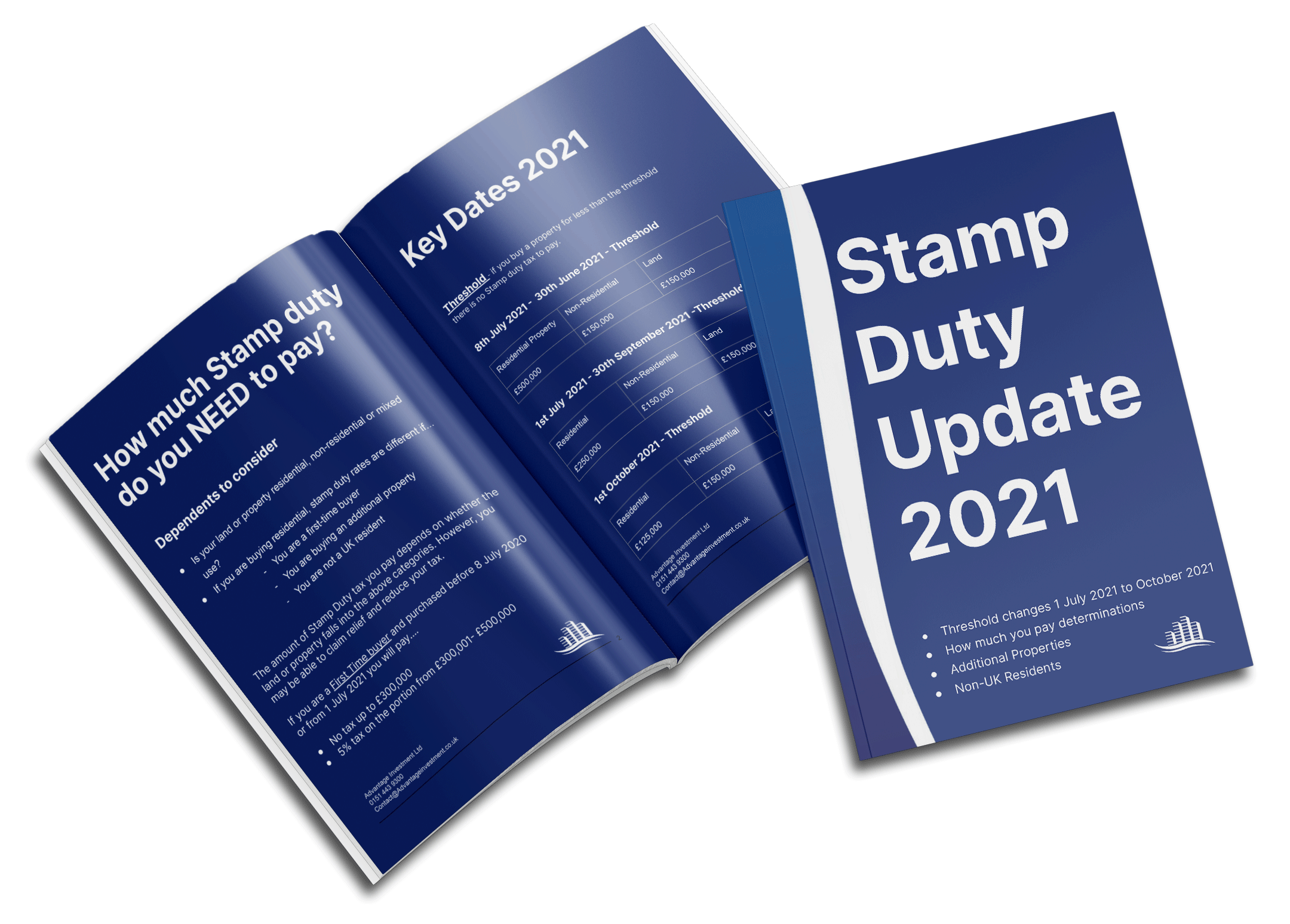

When calculating the financials on a property investment strategy to work out the ROI and other key profit details, it is important to understand the tax implications before you decide on a property purchase, especially when it comes to the stamp duty charges. There have been lots of recent changes to stamp duty for first-time buyers and for people buying what is classed as a second property. There have also been changes that affect overseas buyers, with non-residents of the UK now being required to pay an additional amount of stamp duty tax.

Summary of stamp duty rates

On first properties, there is no stamp duty on properties up to £125,000, then the following charges apply from 1 October 2021:

£125,001 – £250,000 2%

£250,001 – £925,000 5%

£925,001 – £1.5m 10%

Over £1.5m 12%

Stamp duty for non-residents of the UK

In April 2021, the UK government introduced an additional stamp duty rate for non-resident buyers purchasing residential property in England and Northern Ireland. Therefore, most overseas buyers will be required to pay an extra 2% stamp duty tax, in addition to the second property stamp duty tax.

Exemptions to the non-resident stamp duty tax

The additional 2% does not apply for non-residential property, or purchases that are mixed residential/commercial.

If you are leasing a property and the lease is for less than 7 years, the stamp duty surcharge would not be applicable.

In Scotland and Wales, there is a different set of rates. For example, in Scotland there is a Land and Buildings Transaction Tax. When buying a first property, there is no stamp duty for properties purchased up to £175,000 and incremented rates apply for properties purchased at higher amounts. There is also an additional dwelling supplement for buying a second property, which is:

Up to £40,000 0%

£0 – £145,000 3%

£145,001 – £250,000 5%

£250,001 – £325,000 8%

£325,001 – £750,000 13%

£750,001+ 15%

What this means for property investors

The stamp duty tax rate charges mean that investors may look to change their strategy for buying in the UK. At Advantage Investment, we have been putting investment opportunities together that are aimed at minimising stamp duty tax for second home purchases.

For example, our luxury lodges based in Scotland are exempt from the stamp duty charge. At Advantage Investment, we find the best property investments to suit our investors’ circumstances, so we can keep stamp duty rates and other costs to an absolute minimum.

Before you consider buying a new property, you should work out what the stamp duty rates are for the country you are purchasing in, as well as what rate applies for the purchase amount and whether there are any exemptions or relief that you should be aware of.

There are many variations of these factors that could affect your total ROI, so stamp duty rates and details should be accurately calculated before you decide what type of property investment to opt for. At Advantage Investment we strategically select locations, purchase prices and types of investment so that our properties offer the highest amount of ROI possible.

Alternatively, give us a call on 0151 433 9300 to discuss our very attractive investment options.